Many home loan loan providers depend on the typical process for providing cash to buyers-- asking candidates for records and also numbers that freelance you may not have. There are a lot of lenders that can supply you various other ways to secure a mortgage loan. Follow these suggestions and do your study so you locate the ideal lending institution that wants to collaborate with your personal scenario.

- Minimum credit report to qualify, but even if you defeat that minimum doesn't indicate a loan provider will give you a home loan.

- Our goal is to give you the most effective advice to aid you make clever individual finance decisions.

- You could need to provide on several residences, particularly in a competitive market.

- Of these numbers, the average three year fixed price saw the largest percentage factor boost, from 3.01% to 3.05%, according to our information.

- She covers home loan rates, refinance rates, loan provider reviews, and homebuying short articles for Personal Financing Expert.

- SoFi charges a lender cost origination fee is $1,495 for non-members, and also $500 for participants who have SoFi individual or pupil loans, or a minimum of $50,000 in a SoFi Invest account.

And also when rates look set to climb instead of loss, it makes sense to lock as opposed to wait on rates to dip daily. Yet there are various other techniques you can make use of to get https://caidenfzdp489.edublogs.org/2022/08/05/5-ideal-home-mortgage-lending-institutions-for-self/ lower offers from the lending institutions you talk with. Other lenders might emphasize ultra-low rates of interest, but fee higher origination costs or price cut indicate offset it.

Exactly How Do I Find The Most Effective Home Loan Price?

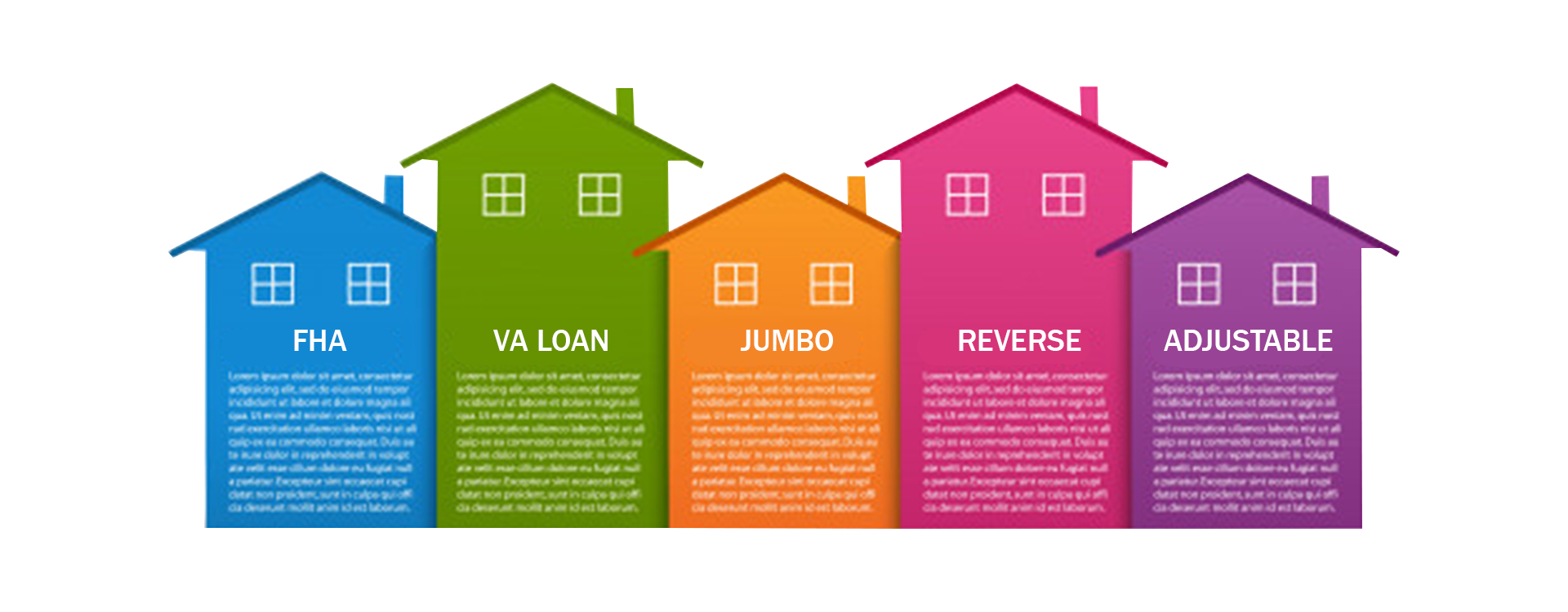

There's constantly some variability between loan providers timeshare how it works on both rates and also terms, so ensure you understand the complete picture of each offer, and consider what will certainly fit your scenario best. Comparison-shopping on Bankrate is specifically smart, due to the fact that our relationships with loan providers can aid you get special low rates. Due to the fact that a home is usually the largest purchase a person makes, a mortgage is generally a household's biggest piece of financial obligation. It is necessary to get ready for the home mortgage application process to guarantee you get the most effective price as well as month-to-month repayments within your budget plan. VA lendings and USDA finances normally have the most affordable mortgage rates of any program, but there are special requirements to qualify.

What Is A Home Mortgage Rate?

A jumbo car loan is one that deserves more than adhering loan criteria in your location. You generally need a jumbo car loan if you intend to get a high-value building. As an example, you can get up to $2 million in a big car loan if you select Rocket Home loan. The adhering car loan restriction in a lot of components of the country is $647,200.

Just How To Get A Mortgage

For the size of the term, you are obliged to their problems and charges. In today's low interest rate environment, it's not specific if rates of interest can continue to reduce additionally. While the emphasis can be on the direction of the adjustment, you ought to additionally focus on how large the interest rate changes can be.

VA home mortgages need no deposit, however debtors hank larkin smith pay an one-time VA funding charge, which can be rolled right into the funding. May give existing clients a discount on mortgage lender source costs. Fully personalized mortgage prices not available without providing contact details. Does not use jumbo mortgages or house equity lines of credit. Watermark supplies traditional loans with as little as 3% down.

Surefire Price provides both branch areas and also on the internet accessibility to borrowers who wish to get a home mortgage Its paperless application procedure allows debtors to send documentation electronically as well as apply as well as keep track of the application process online. Mr. Cooper offers consumers an enhanced electronic experience once the financing is secured, specifically through its customer dashboard. Its House Knowledge mobile application helps clients take care of not simply a mortgage yet their more comprehensive financial wellness.

LoanDepot's borrowing police officers comply with an internal "no guiding" policy, which suggests they don't have any type of incentive to push you toward one lending over an additional. So, when you re-finance a loan, you're most likely to have refinance alternatives that work in your favor. Your mortgage not only helps you get a residence, it is most likely the largest lending you will ever take out in your life. And due to the fact that the funding is so huge, getting authorized at the very best possible rate of interest is not constantly easy. Eric Rosenberg is a financial writer with more than a years of experience working in financial and also business accounting.