Because darkness banks would certainly come to be much more dominant, greater resources requirements would certainly additionally move mortgage credit report risk off bank annual report to the GSEs and indirectly to the united state There's a whole lot taking place behind the scenes of the mortgage market that debtors might not be aware of. Since it purchases a significant section of mortgage, the second market drives a great deal of the habits in the main market, such as the financial institutions' wish to write adapting fundings. While you may continue to make your regular monthly payment to the financial institution that came from the loan, the money may actually be going to several financiers who own your home mortgage or a piece of it. In the United States, the most typical securitization trusts are sponsored by Fannie Mae and Freddie Mac, US government-sponsored ventures. Ginnie Mae, a United States government-sponsored enterprise backed by the complete confidence and credit report of the US government, assurances that its financiers obtain prompt settlements but buys limited numbers of home mortgage notes.

- Lenders normally provide an initial or main home mortgage before they permit a second mortgage.

- Typically, purchasers took down around 20 percent of your house's price.

- We're dedicated to providing you with a high quality solution, so calls might be videotaped or monitored for training functions and to aid us develop our services.

- When it comes to Ginnie Mae, this warranty is backed with the full confidence and credit of the US federal government.

At NatWest, our home mortgage consumers need to set up a Direct Debit, providing us permission to take month-to-month settlements out of their checking account on an agreed day in the month. For the majority of consumers, a residence is the most costly point they'll ever acquire. The quantity of money Rachel Ansley as well as the length of time associated with a regular home loan suggest that extremely small distinctions in the regards to 2 competing loan offers can amount to some serious money. When you take that into account, it's unusual that individuals aren't extra hostile about shopping for a home mortgage than they are. " A lending institution can not transform the terms, equilibrium or rates of interest of the loan from those set forth in the records you originally signed. As well as it should have no effect on your credit history," claims Whitman.

Fighting With Home Loans

These laws were brought in by the Reserve bank in 2015 and also have actually been modified a number of times. Note that home mortgage rate of interest relief is no more available for new home mortgages. Nevertheless, if you are a newbie customer, you may be entitled to claim First Time Customers' Relief, which is a refund of Deposit Passion Retention Tax. It can be taxing and may appear like a lot of job, but when you consider the amount of money that's mosting likely to be involved, thoroughly investigating your home loan choices is time well invested. Figure out exactly how to schedule an appointment to begin your home mortgage application, and also see the list of files and also details you'll require to give.

Market Size And Also Liquidity

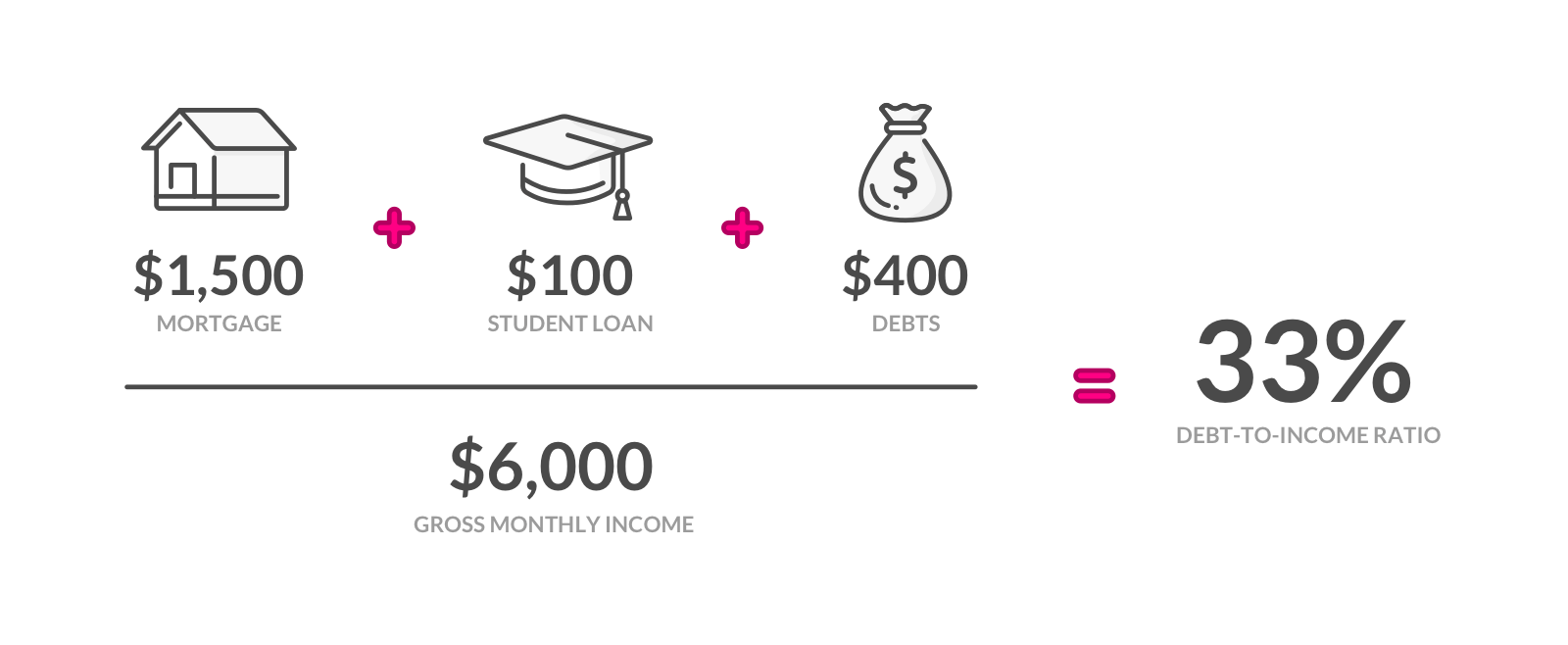

Regardless of which alternative you select, compare rates throughout kinds to ensure that you're getting the best deal. For example, a property buyer pledges their house to their loan provider, which after that has an insurance claim on the building. This ensures the loan provider's passion in the property must the buyer default on their monetary commitment. When it comes to a foreclosure, the loan provider may force out the locals, market the residential or commercial property, and also utilize the cash from the sale to settle the mortgage debt. There are objective factors to incorporate into a cost calculation. They can include the borrower's credit rating, the debtor's performance, the continuing to be number of payments, the lending's rate of interest, the car loan kind and the loan's final maturity day.

It features a http://cristianglum228.wpsuo.com/exactly-how-a-reverse-mortgage-works-in-2022 details maturation day, however the typical life might be much less than the mentioned maturation age. But waiting three decades to accumulate a total amount of $140,000 does not always appear that attracting to financial institutions. So if they wish to make a quicker profit, they'll market your home loan for a payment. As a client, this implies you'll still take care of the exact same lender you financed your residence via.

When your mortgage has been sold, it is essential to make certain that your payments are made in a timely manner and to the correct establishment. As explained above, financial institutions sell home mortgages for factors of their own, primarily since they intend to generate income or increase their offered credit report. That said, it is very important to keep in mind that your approval isn't needed if your bank makes a decision to offer your home loan. Can You Rent A Timeshare Nonetheless, there's one method to find out whether your financial institution or financial institution will certainly offer your loan. When you add home mortgages to the mix, it can come to be much more challenging. From rate of interest to shutting costs, it can be hard to track everything it requires to end up being a house owner.